top of page

EHLS: 2025 a Year

TO REMEMBER The chart reflects market prices (MKT). The fund’s expense ratio is 2.62%, which includes estimated dividends and interest expense on short positions. If this were excluded, the expense ratio would be 1.15%. The fund's inception was 4/2/2024. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or

Jan 85 min read

EHLS: Volatility Continues

IN NOVEMBER The chart reflects market prices (MKT). The fund’s expense ratio is 2.62%, which includes estimated dividends and interest expense on short positions. If this were excluded, the expense ratio would be 1.15%. The fund's inception was 4/2/2024. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when sold or

Dec 4, 20255 min read

EHLS: New Monthly Highs

AMID MINING COMPANY VOLATILITY The chart reflects market prices (MKT). The fund’s expense ratio is 2.62%, which includes estimated dividends and interest expense on short positions. If this were excluded, the expense ratio would be 1.15%. The fund's inception was 4/2/2024. The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's s

Nov 7, 20254 min read

EHLS: Strongest Monthly Return Since November 2024

As AI-Theme Continues The chart reflects market prices (MKT). The fund’s expense ratio is 2.62%, which includes estimated dividends and...

Oct 8, 20256 min read

EHLS: Strong Market Gains Continue

Strength Seen from the Bottom Up In This Update Market Recovery and Volatility: The market has shown resilience, rebounding from a steep...

Sep 5, 20255 min read

EHLS: Speculative Traders Skewing Markets

Difficulties in Shorting In This Update Speculative Trading Surge: July saw a dramatic rise in speculative trading, complicating the...

Aug 6, 20255 min read

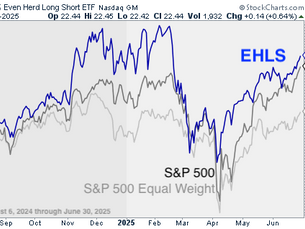

EHLS: Delivering a Postive First Half

As Geopolotics Disrupts Markets The chart reflects market prices ("MKT"). The fund’s expense ratio is 1.58%, which includes estimated...

Jul 2, 20255 min read

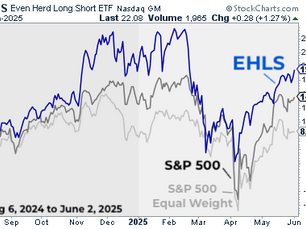

EHLS: Outperforming Since August Lows

Despite Sharp Market Gyrations The chart reflects market prices ("MKT"). The fund’s expense ratio is 1.58%, which includes estimated...

Jun 9, 20254 min read

EHLS: Strong Performance Through Trade War

Fund Gained During Market Volatility The chart reflects market prices ("MKT"). The fund’s expense ratio is 1.58%, which includes...

May 2, 20255 min read

EHLS: Market Turmoil Continues

Extreme Sector Rotation Observed In This Update Enhanced Clustering: Our revised clustering methodology, briefly mentioned last month,...

Apr 2, 20257 min read

EHLS: Momentum Factors Converge

Prioritizing Cluster Enhancements Slipping from a strong start to the year of roughly +6.5% to down -2.04% (-1.84% relative to NAV) by...

Mar 6, 20256 min read

EHLS: Surging nearly +26%

Since the August 5th Market Lows EHLS & Indices Since August Low The fund’s expense ratio is 1.58%, which includes estimated dividends...

Feb 6, 20256 min read

EHLS: Happy New Year! A Strong First Year

Despite Launching Nine Months Ago EHLS Performance Since Launch The fund’s expense ratio is 1.58%, which includes estimated dividends and...

Jan 3, 20254 min read

Even Herd Announces Yearly Distributions on $EHLS

Even Herd announced yearly distributions on the Even Herd Long/Short ETF (EHLS). Distribution as of 12/16/2024 ETFTicker Distribution...

Dec 17, 20241 min read

EHLS: Strong November Gains

Outperforming the S&P 500 by a wide margin Explore our newly released fact sheet for a closer look at the November month-end portfolio...

Dec 4, 20243 min read

bottom of page